The Crypto Brief Deep Dive: US Regulatory Gaps Hinder Crypto

About the Author, Ari Siegel

Managed TradFi fund for 10 years

Bought Bitcoin in 2013 @ $21

Crypto investment consultant 2017

Founded Atreon Capital 2021

Yale MBA

Follow me on social media to see breaking news and insights.

Uncertainty means risk

The current U.S. crypto regulatory landscape doesn’t foster efficiency. It creates uncertainty. Uncertainty means risk. Risk means the largest pools of money are cautious to invest. A major concern to big players operating or investing in the digital assets space: any crypto project or token might in the future be considered an unregistered security, with the potential for regulators to file action. It is almost impossible today to determine which cryptocurrencies will fall under that category in the future. Untethered investment is challenging in a world without rules.

The Crypto Brief has chosen Regulation as its #1 Long-Term Crypto Driver, and it’s currently Bearish. Regulation is key to a stable crypto future. All other news and factors that move prices pale in comparison to the long-term impact regulation would have on the crypto landscape. Digital value transfer is a direct threat to a top-tier government’s greatest source of power: its reserve currency. Since the US Dollar (USD) commands top status, the U.S. must lead in regulation, and it has not done so.

This Deep Dive’s focus is on the key U.S. regulatory gaps that hinder crypto operators and investors, and how future regulation might affect the digital assets landscape.

Unanswered Questions

Crypto has become a significant enough ecosystem to warrant regulation and was so certainly as far back as 2017, if not earlier. While some regulation has occurred addressing basic issues, gaping holes persist:

Which cryptocurrencies are securities, and which are not?

How can operators function in a space where lack of regulatory clarity creates significant uncertainty?

How does incomplete IRS guidance effect taxpayers exposed to income or gains from airdrops, forked coins, staking and yield farming?

It is concerning that after so many years, the Securities and Exchange Commission (“SEC”) and the Commodities Futures Trading Commission (“CFTC”), U.S. regulators of securities and commodities respectively, continue to ignore their duties. Congress has also failed to step in and legislate crypto rules. Worse, instead of setting clear guidelines for the playing field, U.S. regulators are practicing enforcement-after-the-fact.

Reasons why regulators may be hesitating to act

1. Data

Regulators may be slow to act due to a need to gather and analyze more data. One key input, the potential effects crypto could have on the US dollar, is complicated and multi-faceted. Another dynamic is crypto’s effects on the domestic financial system. The US Treasury, Fed, banks, exchanges, Wall Street, and others represent unique incentives and considerations related to crypto as a currency, financial tool, and investable asset class. Decentralized finance (DeFi) presents new challenges for the legacy financial system. A third factor is uncertainty over how current regulatory and legal precedents apply to crypto, such as the Howey Test to determine if a token is a security. This last area of ambiguity has led to recent SEC actions filed against Coinbase and Ripple.

2. Protection of U.S. Reserve Currency vs. Crypto Competitiveness

U.S. regulators grapple with crypto’s potential effect on USD as the world’s reserve currency. In this vein, they may be unsure how to proceed for fear of damaging USD’s status. This is a thin tightrope to walk. On one side, tight crypto regulation interferes with U.S. ability to lead in blockchain technology and value transfer, with global competitive implications. On the other side, loose regulation risks cryptocurrencies growing to threaten USD’s reserve status. This paradox gives regulators motive for hesitation and delay. Per Omid Malekan: “This relatively new threat to the dollar is one explanation for why America refuses to pass sensible crypto regulations, despite a thriving domestic industry. The more the U.S. normalizes Bitcoin as a store of value internally, the higher the odds that it gets adopted as a reserve asset abroad.”

Moreover, regulators may be subject to lobby by multiple parties, each with its own incentives. The SEC and CFTC are mandated to act independently of Congress, the Fed, the Treasury, the banking system, powerful financial firms and individuals, and other players (The Important of Independence, SEC Chair Mary Jo White, 2013). That said, it seems probable that conversations behind closed doors influence their decisions, particularly when it comes to safeguarding Wall Street and government interests.

3. Incentives

Protection of the U.S. reserve currency is an incentive. Additionally the Federal Reserve may have plans to issue a Central Bank Digital Currency (“CBDC”). China has moved forward with its digital yuan. Although a possible U.S. CBDC is years away, it is feasible regulators have knowledge of issuance plans. More likely there is just significant uncertainty, both around CBDCs, and crypto’s long-term effect on USD. Each gives cause to pause.

Some regulatory actions to date have hinted at an incentive to pick winners and losers, which would introduce the possibility of conflicts of interest. The December 2020 SEC case against Ripple is a case in point. Ripple’s XRP token competes against the legacy banking system as an intermediary for faster and cheaper world money transfer. The SEC filed action against Ripple and its founders on the grounds they sold tokens to the public in the project’s early years. There is question as to why regulators targeted Ripple, as many other projects acted comparably, including Ethereum. A major reason could be that XRP jeopardizes the existence of the legacy banking SWIFT system, and potentially threatens USD as the intermediary for world money transfer.

Another incentive would be more lurid: personal enrichment. William Hinman was SEC Director from May 2017 through December 2020. In June 2018, when XRP was the #3 crypto token, behind Ethereum and Bitcoin, Mr. Hinman announced the commission would not be treating Bitcoin or Ethereum as securities, but did not mention XRP. Two years later, the SEC filed the Ripple action. It may be coincidence that Hinman left law firm Simpson Thacher to join the SEC in 2017, and returned to that same law firm when he left the SEC in 2020. Simpson Thacher sits on the Enterprise Ethereum Alliance, and government documents indicate Hinman received over $15 million in payments from Simpson Thacher while he worked at the SEC. Another interesting note, per Bloomberg news: “Marc Berger, who stepped down from his role at the US Securities and Exchange Commission (SEC) in January 2021, will join New York-based Simpson Thacher in June. Berger was instrumental in bringing legal action against Ripple on allegations of selling an unregistered security in the XRP token.”

XRP was the #3 crypto token the day before the SEC filed suit against Ripple. Two months later, XRP was #7, down 25%, while Ethereum price had doubled.

4. Politics

The SEC and CFTC have been engaged in a territorial pissing match over dibs on regulating Crypto. Several SEC and CTFC Chairs have come and gone since Bitcoin’s genesis in 2009. Each with their own opinion, agenda, and influence on crypto regulation. Over the past decade Congress, which can legislate regulation, has been a house divided. While several legislative bills have been introduced, none of significance has passed into law. The end result has been an era of bickering and failed proposals.

Potential Outcomes

While the potential outcomes of regulation are many, three are in focus here:

Bitcoin reigns supreme

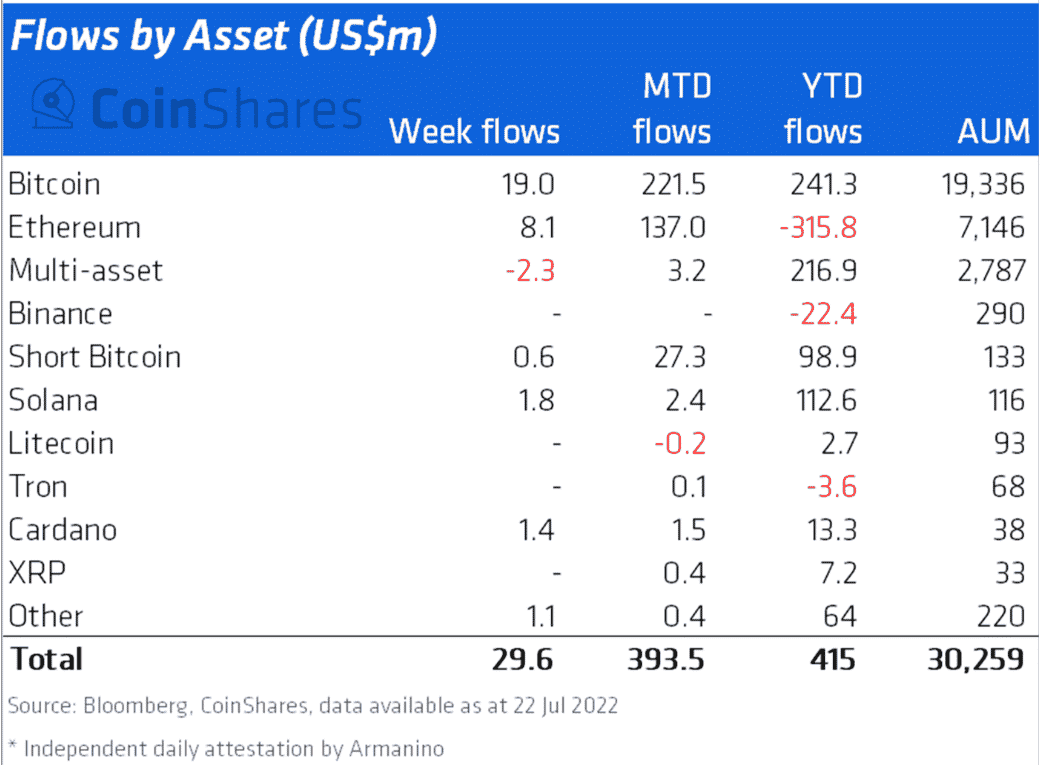

The SEC has time and again signaled it considers Bitcoin a non-security, or rather, THE non-security. While former Director Hinman included Ethereum as a non-security in his 2018 announcement, more recently Chair Gary Gensler has backed away from that stance. If there is a feedback loop between Wall Street and regulators, the former is informing the latter that it considers Bitcoin king. While firms like Fidelity and Blackrock have stepped into crypto, they have limited client crypto exposure to just Bitcoin. According to CoinShare, Bitcoin commands a 65% market share of crypto fund assets. On the institutional side, where regulatory and custody concerns are paramount, Bitcoin likely holds a much higher share of investor interest.

Clearly, regulators and Wall Street have implied Bitcoin is the most likely crypto to survive from a regulatory perspective. If Ethereum and others are deemed securities, then exchanges, issuers, banks, funds, and other players will be hit with onerous regulatory requirements. These include, SEC registration, reporting, filings, capital reserves, and limits on token purchasers.

Bitcoin’s main use case has evolved to store of value, acting as digital gold. New Bitcoin is released through rewards to miners who validate the network. Its ongoing management is decentralized among a loose group of individual developers with no clear leader.

Bitcoin’s case for regulation as a commodity, and not a security:

YES use case

YES token distribution

YES operations

Ethereum is a virtual decentralized computer network, a logical-crypto wherein any developer can code complex applications through smart contracts. It was initially distributed through an ICO, whereby the public bought Ether by depositing Bitcoin. Ethereum’s development and management appears more centralized than Bitcoin’s, with an organized development team and a vocal leader in Vitalik Buterin.

Ethereum’s case for regulation as a commodity, and not a security:

YES use case

? token distribution

NO operations

Ethereum plans to change from Proof-of-Work to Proof-of-Stake (“POS”) via its Merge in Sep 2022. This move may solidify its status as a security. In POS, stakers lock up tokens to validate a blockchain network, and in return receive Ethereum as an economic incentive. Staking could be considered an “investment contract”, a key property of a security. There are dozens if not hundreds of crypto projects competing in those and other use cases. Many of those may rightfully be deemed securities.

It is unlikely that regulation would ban all crypto except Bitcoin. However, there is a significant possibility that regulation could crown it the decisive winner, or at least the solid leader. That outcome becomes much more likely if Ethereum is deemed a security.

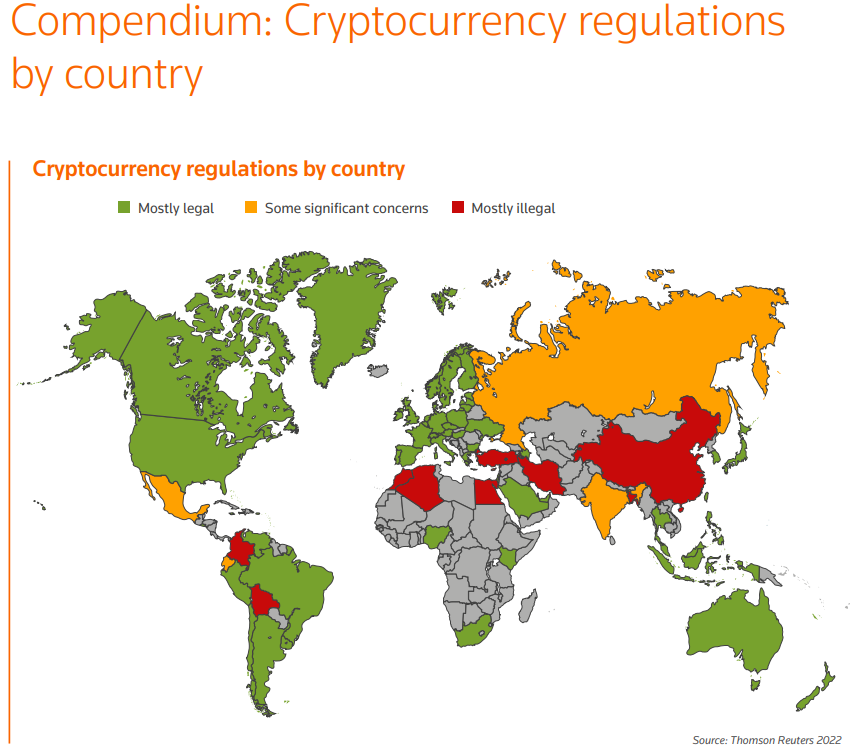

Crypto is outlawed

As outlined previously, crypto remains a threat to USD as the global reserve currency. It can also be difficult to track. While it may be hard to imagine the U.S. banning crypto completely, it is possible. China has banned crypto and moved forward with the digital yuan. Other countries have also declared bans. The challenges to a U.S. ban are manifold.

The U.S. brand embraces freedom, privacy, choice, world leadership and global competitiveness. Yet clearly laws and regulations are in place to fit that brand into a viable human ecosystem. Crypto represents a challenge to that ecosystem. Concurrently, it represents a value transfer technology that reduces friction, fosters economic growth, and promotes inclusion of underbanked, underdeveloped, and underserved individuals and countries. Regulators must balance these motivations.

While a U.S. crypto ban might ostensibly protect USD, at the same time it risks hindering U.S. global financial competitiveness, which could hurt USD. A full crypto ban is a possible, but unlikely outcome. The U.S. launching a CBDC positioned to render crypto as a currency or store of value obsolete, while regulators allowing some crypto activity to remain, is a more likely scenario.

Something in between

Theoretically, regulation is reflexive, meaning it will exhibit momentum. While years have passed without much progress, a single watershed moment may be the catalyst for a rapid momentous regulatory shift toward clarity. The dynamics of that moment - whether it be a perceived attack on USD, or a clear setback in global competitiveness - will shape the direction of U.S. crypto regulation.

Currently, Bitcoin appears to be the anointed one, as U.S. regulators, Congress, and Wall Street have consistently signaled they do not consider it a security. That could change. At the forefront now, is the question of whether Ethereum and other tokens will be deemed securities. Such categorization would certainly stymie their growth.

The most likely outcome is crypto is not banned, but regulation challenges the growth of tokens that are not Bitcoin, or similar enough to it. Such challenges have been overcome by actors in other regulated ecosystems. Ethereum and several others have the resources and incentive to do so.

Final Note

The U.S. promotes itself as champion of freedom, capitalism, efficient markets, and technological advance. Crypto requires capital from investors to solidify its place as a new asset class and a revolutionary public decentralized technology. Crypto technology can reduce frictions which hamper economic exchange and development in the U.S. and globally. It provides freedom and access to unfettered money and transfer of value. Without regulation that allows crypto investors, operators, and users to understand the playing field and measure risks, crypto’s progress is hindered. It seems ironic that U.S. regulators remain on the bench while possibly the most exciting human-connection event since the Internet plays out on the field. Until they act, the game will go on without any certainty as to its outcome.

Deep Dive #2: History of US Crypto Regulation

In 2013, the US Financial Crimes Enforcement Network determined cryptocurrencies do not "have legal tender status in any jurisdiction."

The sale of crypto is generally only regulated if the sale (i) constitutes the sale of a security under state or Federal law, or (ii) is considered money transmission under state law or conduct otherwise making the person a money services business.

SEC: Securities oversight

SEC has regulatory authority over the issuance or resale of any token or other digital asset that constitutes “an investment contract”, which has been defined by the U.S. Supreme Court as an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others. SEC v W.J. Howey Co, 328 U.S. 293, 301 (1946)

The SEC has been clear on its position that even if a token issued in an initial coin offering (ICO) has “utility” the token can still be deemed to be a security that is regulated under the Securities Act if it meets elements of the Howey Test (Chair Clayton to Senate Banking Committee, Feb 6 2018). Director Hinman in his June 2018 speech suggested that a token whose initial sale defined it as a security, might thereafter be sold as a non-security where the facts and circumstances have changed over time, such that the Howey Test is no longer met.

That said, the SEC has not clarified which specific crypto tokens are considered securities, and which are not. Nor has it given any clear guidance that would allow crypto entities to determine how to structure and run their operations to avoid their tokens being deemed a security.

SEC: Enforcement of securities regulation

If a digital asset is deemed a security, then the issuer must register the security with the SEC or offer it pursuant to registration exemptions. The exemptions generally limit token sales to accredited investors only.

In 2017 Kik Interactive Inc launched an Initial Coin Offering (“ICO”) of its Kin tokens. The SEC argued the ICO violated U.S. securities laws, and in 2020, a Federal court found that sales of Kin tokens constituted investment contracts, and hence were securities. Kik agreed to pay a $5M penalty.

In July 2019 Telegram ICO’ed its GRAM tokens utilizing a Simple Agreement for Future Tokens (similar to the commonly used Simple Agreement for Future Equity). In October 2019, the SEC filed a complaint against Telegram stating its $1.7B raise was to finance business operations, and thus its tokens were unregistered securities per the Howey Test. Telegram ultimately abandoned GRAMs, repaid $1.2B to investors, and paid a $19M penalty.

The Telegram and Kik proceedings brought an end to the ICO era in the U.S. Issuers had to limit sales to non-US and accredited-US persons. The case of SEC v Ripple, as detailed previously, and the recent Coinbase insider trading action, may provide more clarity on which crypto tokens are securities. Or, as has been the case to date with previous actions, they may not.

SEC: EFTs

Several financial firms have applied to operate a regulated EFT holding actual Bitcoin, which would trade on major U.S. exchanges. To date, the SEC has denied all such applications, including those from NYDIG, Grayscale, and Bitwise. Proshares’ ETF was approved, as it only utilizes Bitcoin futures, which are CFTC approved and regulated.

FinCEN: Money services businesses (“MSBs”) and anti-money laundering (“AML’)

Through the Bank Secrecy Act, FinCEN regulates MSBs. In 2013, FinCEN defined an MSB as: (1) A virtual currency exchange; (2) an administrator of a centralized repository of virtual currency who has the authority to both issue and redeem the virtual currency.

MSBs must conduct a comprehensive risk assessment on money laundering exposure, and implement an AML program. The program involves written policies, daily compliance, personnel training, and independent review. OFAC lists need to be referenced to identity restricted foreign nationals and their affiliates, and their activities must be blocked and assets potentially frozen.

Cryptocurrency exchanges are legal in the United States and fall under the regulatory scope of FinCEN. They must register with FinCEN, implement an AML/CFT program, maintain appropriate records, and submit reports to the authorities. DeFi projects are generally unregistered, and represent a potential conflict with MSB and AML requirements. In 2021, there was a report that the SEC was investigating Uniswap, the largest DeFi exchange.

The US Treasury has emphasized an urgent need for crypto regulations to combat global and domestic criminal activities. In December 2020, FINCEN proposed a new cryptocurrency regulation to impose data collection requirements on cryptocurrency exchanges and wallets. The rule is expected to be implemented by Fall 2022, and would require exchanges to submit suspicious activity reports (SAR) for transactions over $10,000 and require wallet owners to identify themselves when sending more than $3,000 in a single transaction.

CFTC

Futures, options, swaps and other derivative contracts that make reference to the price of a crypto token that constitutes a commodity are subject to regulation by the CFTC.

The CFTC and SEC have been involved in a years-long dispute over crypto oversight. The conflict centers on whether crypto tokens should be considered securities or commodities. The CFTC has permitted registered Bitcoin and Ethereum futures contracts to trade on the Chicago Mercantile Exchange (CME). It currently permits options on Bitcoin futures to trade on the CME, and on Aug 18, 2022 announced it will authorize options on Ether futures on the CME beginning Sept 12, 2022. The CFTC has taken actions to shut down unregistered crypto options exchanges globally.

Congress and Executive Branch

Since 2021, Congress has seen 50 bills introduced related specifically to crypto regulation. Not one has passed into law. The recent Lummis/Gillibrand bill appears to give majority oversight to the CFTC, but doesn’t clearly address which digital assets would be considered securities, and thus in the SEC’s purview. It states: “Excluded from the CFTC’s jurisdiction are digital assets that provide the holder with any of the following rights with respect to a business entity: (1) a debt or equity interest, (2) liquidation rights, (3) an entitlement to an interest or dividend payment, (4) a profit or revenue share derived solely from the entrepreneurial or managerial efforts of others, or (5) any other financial interest. Such assets are subject to the SEC’s jurisdiction.” (Ropes Gray). The Lummis bill also does not address NFT regulation.

Biden’s Infrastructure bill became public law on November 15, 2021. Key takeaways:

Reporting requirements for certain transactions involving over $10,000 in “digital assets,” including cryptocurrencies.

Possible requirements of businesses to collect new types of information and report to the IRS details of crypto transactions.

A new definition of broker as “any person who is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.’’

Facebook’s token

In 2019, Facebook attempted to launch a token called Libra. Although no action was taken against Facebook, the company shelved the project. This action was due to members of Congress and regulators voicing fears about money laundering, consumer protections, and other concerns. Facebook rebranded it to Diem in 2021, as a dollar-pegged stablecoin. This decision brought increased resistance from regulators. In 2022, Facebook sold Diem’s assets to Silvergate Bank for $200M.

Tax

In 2014, the IRS declared virtual currency would be taxed as property and not currency. Owners of crypto must: keep detailed buy/sell records, pay taxes on gains from sales of crypto for cash, pay taxes on gains from crypto used in purchases of goods or services, and pay taxes on mined crypto. Exchanging one crypto for another is considered a taxable event.

Tax guidance in some areas of crypto are still opaque. Even though the IRS tried to clarify, they left areas of uncertainty. An example is crypto acquired through a hard fork or airdrop, such as 2017’s Bitcoin fork which resulted in Bitcoin Cash tokens distributed to Bitcoin holders at no cost. In 2021, the IRS stated that the Bitcoin Cash hard fork resulted in realized gross income that was taxable as such. It further stated that the tax event date would be marked as when the taxpayer realized “dominion and control” over the Bitcoin Cash tokens. Such guidance is unclear. If the tokens were received through an exchange, is that considered ownership? What if it was a small overseas exchange? If there was considerable risk of loss in transferring tokens to an exchange for pricing discovery, was it still considered in the holders control?